Retail sales surged 5.3 percent in January, far higher than analysts and economists expected, providing a needed jolt to an economy that showed signs of weakening at the end of last year.

The large jump in sales, released Wednesday by the Commerce Department, was most likely fueled by the latest round of stimulus checks that were mailed out at the end of last year. The $600 checks, in addition to some easing in virus outbreaks and the increased distribution of vaccines, helped bring customers back into stores last month.

The positive figures in January, which include a broad swath of consumer spending on clothing, groceries and automobiles, come after three consecutive months of declines. The deep drop around the holidays had some economists predicting that the economy was headed for a “double dip” recession unless the federal government provided more financial assistance to struggling consumers.

After the latest round of stimulus was passed by the Trump administration at the end of 2020, economists expected that retail sales would increase by 1.2 percent in January.

Driving the larger than expected increase last month were strong sales of electronics, which increased 14.7 percent from December, and furniture and home furnishings, which rose 12 percent. Even restaurants, an industry that has been hardest hit by the pandemic, saw strong sales in January, increasing about 7 percent, while auto sales grew 3 percent.

News Corp said on Wednesday that Google had agreed to make “a significant payment” to publish the newspaper publisher’s news content, signaling a breakthrough in a dispute that has dated back to the earliest days of the search engine.

The three-year global deal comes as Australia prepared to pass groundbreaking legislation to force internet platforms to pay for news. In recent days, Google had struck deals with other media companies to ensure that news would remain on its services, but News Corp, a longtime critic of the search giant and publisher of The Wall Street Journal and The Australian, had held out.

Rupert Murdoch’s News Corp has been a vocal and determined critic about how news organizations are not fairly compensated for content that helps to bring in advertising revenue for Google.

Robert Thomson, chief executive of News Corp, said the deal would have “a positive impact on journalism around the globe.” The exact financial terms of the deal were not disclosed.

News Corp said the agreement also included the development of a subscription platform, the sharing of advertising revenue from Google’s technology services and investments into video journalism by YouTube, a Google subsidiary.

Don Harrison, president of global partnerships at Google, said the company had invested to help news organizations over the years. “We hope to announce even more partnerships soon,” he said.

Ford Motor became the latest automaker to accelerate its transition to electric cars, saying Wednesday that its European division would soon begin to phase out vehicles powered by fossil fuels. By 2026, the company will offer only electric and plug-in hybrid models, and by 2030 all passenger cars will run solely on batteries.

The plan is part of a bid to generate steady profits in Europe, where Ford has struggled for several years, as well as to meet increasingly strict emissions standards in the European Union.

“We are going all in on electric vehicles.,” Stuart Rowley, president of Ford of Europe, said during a news conference.

Ford and other automakers are moving more rapidly on electric vehicles in Europe than in the United States. Last year, the European Union began imposing penalties on carmakers that do not adhere to limits on carbon dioxide emissions, forcing them to sell more electric cars.

Ford is a relatively minor player in Europe, with 5 percent of the passenger car market, but it said it planned to spend $1 billion to overhaul its main European plant, in Cologne, Germany, to produce electric vehicles. The first new model is supposed to go into production in 2023, Ford said, and will use electric vehicle technology developed by Volkswagen.

Ford has begun selling its battery powered Mustang Mach-E in Europe and will begin delivering models to European customers during the next few weeks.

All of the delivery vans and commercial vehicles made by Ford of Europe will be electric or plug-in hybrids by 2024, and its entire range of vehicles would be electric or plug-in hybrids two years after that.

However, Ford will continue to sell commercial vehicles with gasoline or diesel engines in Europe for years to come. The company said that, by 2030, two-thirds of the commercial vehicles it sells in Europe will be battery powered.

“There will still be demand for conventionally power vehicles,” Mr. Rowley said.

Last month, General Motors said it aimed to produce only electric vehicles by 2035, but G.M. has all but pulled out of Europe. The company sold its Opel division in 2017 to France’s Peugeot SA. Peugeot recently merged with Fiat Chrysler and is now known as Stellantis.

Jaguar Land Rover said Monday that all of its Jaguar luxury cars, and 60 percent of Land Rover luxury SUVs, will run solely on batteries by 2030.

Robinhood has responded to a long list of questions from Senator Elizabeth Warren, Democrat of Massachusetts, about its businesses practices, and what went wrong during the height of the so-called meme stock mania. The DealBook newsletter got the first look on Wednesday at the broker’s 195-page response.

The questions and responses indicate Ms. Warren’s likely focus as the Senate Banking Committee, of which she is a member, scrutinizes the fintech company and push for securities regulation. More immediately, the back-and-forth serves as a preview of likely themes at a hearing in the House on Thursday on the market frenzy that will include Vlad Tenev, Robinhood’s chief executive.

The letter to Ms. Warren from Robinhood reiterated the company’s previous comments about the capital constraints that forced it to halt trading in some stocks during the height frenzied trading in shares of GameStop, AMC and others.

Robinhood’s responses left open some questions about its relationship with the market maker Citadel Securities. When pressed by Ms. Warren, Robinhood said it did not “share customer data beyond customer orders” with firms like Citadel Securities, although it did not say what was included in those customer orders. When asked how much money it made from Citadel Securities and other financial firms, Robinhood referred to its public disclosures of payment for order flow contracts. Kenneth C. Griffin, the chief of the hedge fund Citadel, will also testify Thursday at the House hearing.

Robinhood also answered Ms. Warren’s inquiries about its use of mandatory arbitration agreements, which can relinquish a user’s right to take the company to court. Robinhood, which said it “is open to reviewing its use of arbitration,” noted that only one of its 2020 cases resulted in a final ruling by an arbiter, with an award for $0.

“Robinhood promised to democratize trading, but hid information about its prerogative to change the rules by cutting off trades without notice — and about customers’ inability to access the courts if they believe they’ve been cheated — behind dozens of pages of legalese,” Ms. Warren said. She may press the Securities and Exchange Commission to ban forced arbitration practices, investigate Robinhood’s relationship with Citadel Securities, explore raising capital requirements for brokerage firms and clarify its rules on market manipulation.

“I’m going to keep pushing regulators to use the full range of their regulatory tools to ensure the fair operation of our markets, particularly for small investors,” Ms. Warren said.

The private equity firm Carlyle Group plans to announce on Wednesday a $4.1 billion credit line for its portfolio companies that will tie the price of debt to the diversity of a company’s board, the DealBook newsletter reports.

Carlyle did not disclose the rates associated with the loans. To help companies increase diversity hiring, it will tap its database of executives along with those of partners like Catalyst and the Latino Corporate Directors Association.

The three-year facility, which the firm says is the largest of its kind in the United States, is part of an “integrated approach to building better businesses,” said Carlyle’s chief executive, Kewsong Lee.

The effort to use the tools of private equity to promote diversity initiatives is part of a broader trend in so-called environmental, social and governance investments as they shift to private capital from the equity markets. Debt issuance in sustainability efforts hit a record $732 billion 2020, up 26 percent from the prior year.

The credit facility is an extension of Carlyle’s goal for the boards of the companies in its portfolio to have a diversity rate of at least 30 percent by next year. Nearly 90 percent of its companies now meet its 2016 goal of having at least one director who is a woman or ethnic minority for companies in the United States or, for companies outside the United States, one director who is a woman.

The firm says the effort is good for business: In a study of its portfolio companies, Carlyle found that firms with two or more diverse board members recorded annual earnings growth 12 percent higher than those with fewer diverse directors.

Carlyle has arranged more than $6 billion in financing linked to its E.S.G. goals, including loans for the packaging firm Logoplaste tied to reducing its emissions; the denim manufacturer Jeanologia, linked to water savings; and the gearbox maker Flender, based on renewable power capacity. The firm estimates that it has saved more than $15 million from those deals.

The coronavirus crisis may have accomplished something that a decade of economic growth could not: It spurred a boom in U.S. entrepreneurship.

An enduring mystery of the pre-pandemic economy was the decades-long slump in business formation. Despite prominent Silicon Valley success stories, the rate at which Americans start companies had been steadily declining.

But in a study released on Wednesday, researchers at the Peterson Institute for International Economics found that Americans started 4.4 million businesses last year, a 24 percent increase from the year before. It is by far the biggest increase on record.

The 2020 boom stands in contrast to the last recession, when start-up activity fell, in part because the financial crisis made it hard for would-be entrepreneurs to get funding. It also sets the United States apart from other rich countries, where start-up activity generally fell last year or rose only slightly. One likely factor is the trillions of dollars in government support for U.S. households and businesses, far more than was available in past recessions or in other countries.

“This is the first recession in the last 50 years where the supply of money is larger than before the crisis,” said Simeon Djankov, one of the report’s authors.

Growth appeared to be strongest in retail and warehouse businesses, perhaps reflecting the boom in e-commerce during the pandemic. There was also a notable increase in health care start-ups.

The report, based on data from the Census Bureau, defines entrepreneurship broadly, covering everything from part-time freelancers to aspiring tech billionaires. Some businesses may be little more than side projects begun by people stuck at home during lockdown.

But a narrower subset of start-ups that the Census Bureau deems likely to hire also rose, by 15.5 percent. If even a small share of them thrive, it could bolster employment and productivity in coming years, Mr. Djankov said.

“It’s enough for a few of them to make breakthroughs,” he said.

Inflation expectations in U.S. financial markets are at multiyear highs, as investors anticipate a large government spending package could stoke higher prices amid easy-money policies. In recent days, this has spurred a sharp sell-off in U.S. government bonds, as some investors bet that the Federal Reserve might tighten monetary policy sooner than previously expected. Inflation also erodes the value of bonds over time.

But that dumping of bonds paused on Wednesday. The 10-year yield was at 1.31 percent, the highest in a year. The previous day, the yield jumped 10 basis points, or 0.1 percentage point, the biggest one-day increase since March. It was at 1.12 percent on Feb. 10.

“That’s far too fast, clearly,” analysts at ING Bank wrote in a note about the move in bond yields.

“The focus is increasingly on the Fed to provide some reassurance that it won’t seek to tighten policy aggressively in the face of faster inflation,” they also wrote.

The central bank will publish the minutes of its January meeting later on Wednesday.

The Biden administration, which is pushing a $1.9 trillion stimulus package, and the Federal Reserve are moving away from the fears of runaway inflation that has plagued some economists since the 1970s, Jim Tankersley and Jeanna Smialek report.

“After years of dire inflation predictions that failed to pan out, the people who run fiscal and monetary policy in Washington have decided the risk of ‘overheating’ the economy is much lower than the risk of failing to heat it up enough,” they wrote.

The 10-year break-even rate, one measure of inflation in markets, was at 2.24 percent, the highest since 2014.

Bonds yields rose across Europe, reversing an earlier decline. The 10-year yield on British bonds rose slightly to 0.62 percent. Earlier data showed the annual inflation rate increased in January.

Stocks

-

On Wall Street, markets opened lower as investors sought out government bonds. The S&P 500 dipped slightly as trading began on Wednesday.

-

The Stoxx 600 Europe fell 0.4 percent led by consumer and financial stocks.

Commodities

-

Natural gas futures for March delivery dropped 2.4 percent, undoing some of the surge on Tuesday when the price jumped more than 7 percent because winter storms in southern and central states increased demand while disrupting production.

-

Oil prices continued to climb higher. Futures for West Texas Intermediate, the U.S. benchmark, were up 0.8 percent to $60.53 a barrel. The price went above $60 a barrel this week for the first time in 13 months. The winter storm over the weekend also cut oil production as wells and refineries in Texas shut down amid freezing temperatures.

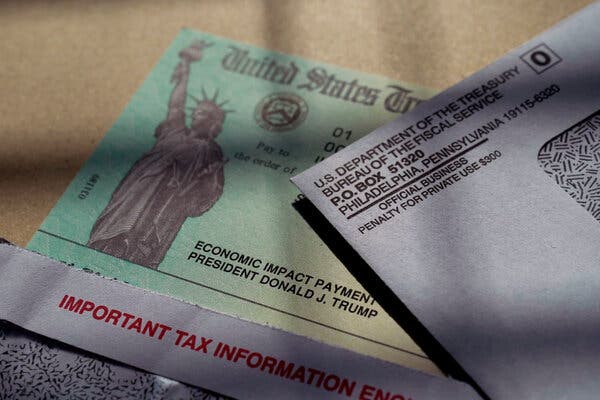

The Internal Revenue Service says your stimulus payment has been sent, but there’s still a chance you’ll have to ask for the money when you file your taxes.

The I.R.S. said on Tuesday that the payments, including the most recent $600 checks and the earlier $1,200 installments, have been issued. Most eligible people should have received their payments by now, even though an estimated 13 million payments were misdirected last month and had to be rerouted.

If you believe part or all of your payment is missing, however, you’ll still be able to recover it through a credit when filing your 2020 tax return. The so-called Recovery Rebate Credit can be found on line 30 of the 2020 Form 1040 or 1040-SR.

It’s quite possible you’re entitled to a bigger check than you received if your financial situation or status changed last year: The recovery credit is based on an individual’s 2020 tax year information, while the most recent stimulus payment was based on the 2019 tax year. (For the first stimulus check, the I.R.S. said a 2018 return may have been used if the 2019 was not filed or processed.)

The quickest way to recover the credit is by filing a tax return electronically — and if you earn $72,000 or less, you can do it for free through the I.R.S. Free File program.

Starting last April, the I.R.S. and Treasury issued more than 160 million payments to taxpayers, totaling more than $270 billion. In the latest round, beginning roughly in early January, the I.R.S. sent more than 147 million payments, totaling more than $142 billion.

The gold standard in masks has been the N95, with its extra-tight fit. There’s also the KN95 from China, which also offers high filtration but is somewhat looser fitting.

But a year into the pandemic, buying a legitimate heavy-duty medical mask online remains downright maddening.

Counterfeiters have flooded the market with fake N95s and KN95s, even on trusted sites like Amazon.

Brian X. Chen recently spent hours comparing masks online and learned about how to spot fraudulent mask listings and how to sidestep fake reviews.

-

The Centers for Disease Control and Prevention has charts of N95 and KN95 masks that the agency has tested, including the make, model number and filtration efficiency. Learn about the trade-offs between the two types of masks.

-

Beware of Amazon. Saoud Khalifah, the founder of FakeSpot, a company that offers tools to detect fake listings and reviews online, said a third-party seller most likely took control of the product listing and sold fakes to make a quick buck. “It’s a bit of a Wild West,” he said. “You think it’s real and suddenly you get sick.”

-

Instead, order from an authorized source that shows proof of authenticity — some manufacturers list steps to verify that a mask is real. You can also sometimes order directly from the manufacturer itself, but often you have to buy a large quantity to reduce the cost.