Lael Brainard, one of the Federal Reserve’s Washington-based governors, on Tuesday offered the first major hint that a wild ride in bond markets over the past week may have raised alarms at the U.S. central bank.

“I am paying close attention to market developments — some of those moves last week and the speed of those moves caught my eye,” Ms. Brainard said, speaking at a Council on Foreign Relations webcast. “I would be concerned if I saw disorderly conditions or persistent tightening in financial conditions that could slow progress toward our goal.”

Ms. Brainard’s comments came after government bond yields climbed last week, a jump that rippled through financial markets. After dropping as low as about 0.5 percent in 2020,

the yield on a 10-year Treasury note — basically the rate the United States government must pay to borrow money for a decade — jumped above 1.6 percent on Thursday. It has retreated since, and by Tuesday it was around 1.41 percent.

The recent rise in bond yields seems to be driven by a belief among investors that growth and inflation will shoot higher this year, which could prompt the Fed to pull back on its support for the economy and markets sooner than previously expected. Fed officials have been clear that they will be patient in removing their policy help and that although they expect price gains to pop later this year, the increase is unlikely to last.

Fed officials had maintained a sanguine tone as bond yields climbed last week.

“In a way, it’s a statement of confidence on the part of markets that we will have a robust and ultimately complete recovery,” Jerome H. Powell, the Fed’s chair, said of climbing yields during congressional testimony earlier last week.

But higher government bond yields also affect borrowing costs for everyone from home buyers to big companies, and the sudden jump startled investors.

Analysts had been waiting for the Fed to voice concern about the move, or even to hint that they might do something to bring yields down. Some said the tumult on Thursday in particular felt reminiscent of trading in the early days of the pandemic last March, when Treasury markets careened out of control until the Fed intervened.

Mary C. Daly, the president of the Federal Reserve Bank of San Francisco, noted on a call with reporters on Tuesday that the Fed has ways to control rising yields, should it choose to.

“We do have these other tools, and one of them is changing the composition of asset prices,” she said, referring to a policy in which the Fed could shift toward buying more longer-term bonds in a bid to hold down interest rates.

Ms. Daly said that while she and her colleagues think about such policies on a regular basis, she isn’t worried about the yield moves so far.

The audience for NBC’s Sunday night broadcast of the Golden Globes fell dramatically, with 6.9 million people watching the annual Hollywood ceremony, according to Nielsen.

Even by the standards of declining award-show ratings, this one was a whopper. The viewing audience shrank by 62 percent compared with last year’s show, which drew more than 18 million people. It was the smallest audience for any Globes ceremony since NBC started broadcasting the event in 1996.

The show had a lot going against it. Because of the pandemic, it was moved out of its customary January time slot, meaning it lost its usual lead-in, a National Football League playoff game. This year’s event also skipped the red-carpet parade of stars wearing the latest in fashion from name designers.

Hosted by Tina Fey and Amy Poehler on separate coasts, the ceremony took place in front of a small crowd of emergency medical workers and others with essential jobs instead of Hollywood celebrities seated elbow-to-elbow in the cramped Beverly Hilton ballroom as drinks flowed. With winners and nominees beamed in remotely, the night also included technical glitches. And because movie theaters have been shut down, viewers were not as likely to have seen — or even to have heard of — many of the movies that were up for awards.

In the days leading up to the event, The Los Angeles Times, The New York Times and other news media organizations published articles critical of the Hollywood Foreign Press Association, a nonprofit, tax-exempt organization with 87 members that started handing out Golden Globes in the 1940s. The articles noted that the group has no Black members and raised questions about its financial practices.

All awards shows have suffered ratings declines in recent years. But the audience for the Golden Globes had held steady, ranging between 18 and 20 million viewers since 2013. Last year, it even came within 5 million viewers of the Academy Awards, a number that seemed to justify NBC’s 2018 deal to pay $60 million a year for broadcast rights to the Golden Globes.

The audience for Sunday night’s show was only slightly larger than the one for the bare-bones Golden Globes telecast that revealed the winners in 2008 — effectively a news conference — when the ceremony was canceled because of a writers’ strike.

ABC now faces the challenge of trying to figure out ways to entice viewers to its Academy Awards show on April 25. Last year’s Oscars ceremony had an audience of 23 million viewers.

President Biden’s picks to lead the Securities and Exchange Commission and the Consumer Financial Protection Bureau laid out their regulatory agendas before the Senate Banking Committee, emphasizing two goals: transparency in the government’s oversight of powerful interests and effective enforcement that holds companies accountable when they break the law.

Gary Gensler, the nominee to chair the S.E.C., and Rohit Chopra, Mr. Biden’s choice for the consumer bureau nominee, spoke for more than three hours about a range of issues, including climate change, market volatility, student loans, cryptocurrencies and protections for people dealing with the fallout of the coronavirus crisis.

The committee chairman, Senator Sherrod Brown, Democrat of Ohio, said both men were fitting picks to serve “at a time when so many people don’t feel like they have a voice in our economy.”

Republicans pressed both nominees on their views about the limits of regulatory power. Senator Pat Toomey of Pennsylvania, the ranking Republican, said he worried Mr. Gensler would push the bounds of the law to promote a progressive agenda, and he described the agency Mr. Chopra was nominated to lead as “hyperactive.”

The GameStop trading frenzy was a running theme throughout the hearing. Mr. Gensler assured several senators that the S.E.C. would look into the fallout from the huge surge in retail trading last month in the video-game retailer’s shares and the practice employed by some brokerages, including Robinhood, to generate revenue by selling customer trades to other large trading firms. Mr. Gensler said the practice, called payment for order flow, needs to be examined to see if it harms retail investors.

Mr. Toomey opened the hearing by echoing frequent Republican criticisms of the consumer bureau, calling it “arguably the most unaccountable agency in the history of the federal government” and one that has pursued an “activist, anti-business agenda.”

But Mr. Chopra faced a fairly mild grilling, with some Republican senators — most notably Senator John Kennedy of Louisiana — even calling for stricter oversight of financial bad actors. Mr. Kennedy suggested Congress should tighten the rules on credit bureaus and force them to be more responsive to consumer complaints about inaccurate information on their credit reports.

The hearing’s spiciest moment came when Mr. Toomey pressed Mr. Chopra on a 2016 remark he made accusing lawmakers who backed changes that would curb the consumer bureau’s independence of “shilling for predatory lenders.”

“I regret that, if I said that,” Mr. Chopra responded.

The chief executive of Kohl’s, Michelle Gass, is standing firm against one of the main demands made by a group of activist investors that has taken a 9.5 percent stake in the retailer — selling its properties and then leasing them back.

“We don’t believe sale-leaseback is right for us right now,” Ms. Gass said in an interview on Tuesday, citing the company’s strong investment grade rating and low interest rates that allow for less-constrictive financing options.

The investors — Macellum Advisors, Ancora Holdings, Legion Partners Asset Management and 4010 Capital — revealed their stake in Kohl’s last month. They detailed a long list of complaints and demands in a letter to Kohl’s shareholders and pushed to add nine directors to the company’s 12-member board. They also pushed for sale-leaseback transactions, which they said could bring in $3 billion that the company could put to use by buying back stock.

When asked about the activists’ demands, Ms. Gass said the company would “love to find a common ground.” Adding nine seats, though, is “a control play — and that we are not supportive of,” she said.

Kohl’s said on Tuesday that it was bringing back a dividend and a stock buyback program.

The tussle at Kohl’s is notable because activist investors have recently avoided picking fights with department store chains given the broader challenges the industry faces and the rocky track record activists have had, like William A. Ackman at J.C. Penney and Starboard at Macy’s. And retailers have pushed back against the sale-leaseback strategy, which can temporarily jolt a stock price but can also leave a retailer with less flexibility in the longer term.

“I’ve seen this playbook before,” Terry Lundgren, a former Macy’s chief executive, told CNBC last month. Under Mr. Lundgren’s leadership, Macy’s resisted pressure from Starboard to do its own sale-leaseback program. Kohl’s can improve its performance “with or without outside influences from these investors or other investors,” he said.

Kohl’s on Tuesday reported earnings that topped analyst expectations. Sales still fell — from $6.54 billion to $5.88 billion, as its stores were forced to close in an effort to curb the spread of the coronavirus — but online sales jumped 22 percent and accounted for 42 percent of all total sales.

Other retailers like Target have declined to provide an outlook, but Kohl’s forecast an increase in its net sales over the year prior and an operating margin of up to 5 percent.

“We feel very confident in our guide,” Ms. Gass said.

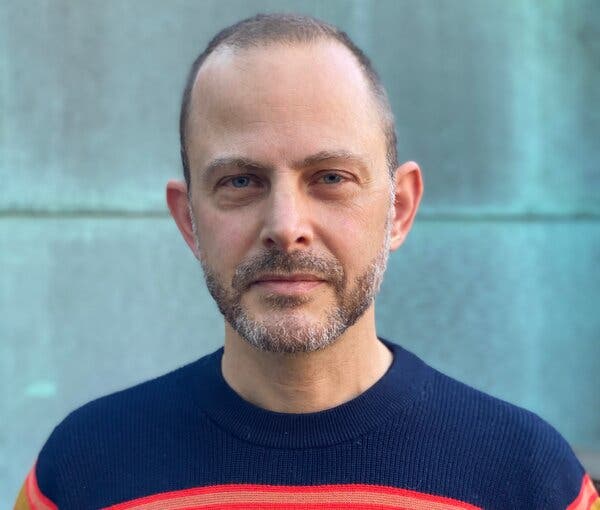

Condé Nast has named Gideon Lichfield as the new global editorial director of Wired.

Anna Wintour, Condé Nast’s chief content officer and the global editorial director of Vogue, made the announcement in an internal memo on Tuesday.

“I am so happy he is bringing his expertise to Wired, and am so excited for the future of the title,” Ms. Wintour wrote in the memo. She said Mr. Lichfield would be responsible for Wired U.S. as well as international editions of Wired, including in Britain, Italy and Japan.

Mr. Lichfield joins Wired with extensive experience in tech and business journalism, most recently at MIT Technology Review, where he had been the editor in chief since 2017. He helped start the digital news site Quartz in 2012 and was previously at The Economist.

Mr. Lichfield said in a news release from Condé Nast that he was “thrilled to be given the chance to work with the excellent journalists at Wired and continue evolving its legacy.”

“Wired is iconic, and it’s been pivotal to shaping technology’s place in the culture,” he said.

He will start on March 22.

The statement noted that Wired saw a 15 percent growth in web traffic last year and reached 44 million people a month across all its platforms.

Nicholas Thompson, who became Wired’s editor in chief in 2017, was appointed chief executive of The Atlantic in December.

The shuffle at Wired is the latest in a series of industry shifts as a variety of publications hunt for top editors. Vox Media announced The Atlantic’s Swati Sharma as the new editor in chief of Vox.com in February. The Los Angeles Times, The Washington Post, Reuters and HuffPost are continuing their searches.

U.S. markets

-

The S&P 500 fell 0.8 percent on Tuesday, a day after it gained 2.4 percent, the biggest one-day gain since June.

-

Traders are recovering from a volatile few days when a sell-off in government bonds rattled the equity markets. This week, the rout has mostly eased. The yield on 10-year U.S. Treasury notes fell to 1.41 percent on Tuesday. It had briefly exceeded 1.6 percent last week.

-

Analysts at RBC Capital Markets said markets had been testing the central banks’ resolve to keep interest rates low globally and that policymakers would have to take action to drive this message home.

-

“However, we remain convinced that the structural upward pressure on yields remains,” they wrote in a note. “The reopening of the economies coupled with sizable fiscal spending programs and supply constraints will make it difficult for bond markets” to gain. Bond prices rise when their yields decline.

-

Shares in Zoom fell 9 percent after rising more than 6 percent in early trading. The video conferencing company said its revenue surged 326 percent in its past fiscal year to $2.65 billion, but doubts remain about its post-pandemic future.

-

Target fell nearly 7 percent. The retailer’s financial results surpassed estimates as it reported on Tuesday that its sales growth last year “was greater than the company’s total sales growth over the prior 11 years.” Analysts noted that it would be difficult for Target to repeat that performance.

Europe

-

Stock indexes across Europe were mostly higher. The Stoxx 600 Europe gained 0.2 percent.

-

The annual inflation rate for the eurozone was 0.9 percent in February, the same as the previous month and in line with economists’ expectations, data published Tuesday showed. “These numbers represent the calm before the storm,” Claus Vistesen, an economist at Pantheon Macroeconomics, wrote in a note. In a few months, he wrote, inflation will jump to reflect the change in energy prices over the past year.

Asia

-

Most stock indexes in Asia dropped after China’s top financial regulator said that the high leverage in the financial system needed to be reduced. Guo Shuqing said he was “very worried” about bubbles in China’s property sector and that bubbles in U.S. and European markets could burst.

Target’s sales continued to climb in the fourth quarter, surpassing analysts estimates, as the retailer capitalized on the shift in consumer shopping habits to buying online and picking up their purchases in stores.

The company said on Tuesday that its sales in the fourth quarter increased nearly 21 percent, higher than the 17 percent that Wall Street expected.

The strong fourth quarter, buoyed in part by stimulus spending by consumers, caps a year of staggering growth at Target. Target reported that its sales growth for 2020 of more than $15 billion “was greater than the company’s total sales growth over the prior 11 years.”

After years of investment in its online ordering and in-store pickup services, the company has emerged as a top winner during the pandemic, gaining billions in market share from less adept retailers.

Amid such strong results in 2020, the company was also being hailed for its decision to raise its starting wage to $15 an hour last year.

“Target tops a record year with a phenomenal fourth quarter,” Molly Kinder, a fellow at the Brookings Institution, wrote on Twitter. “After — but not despite — raising its starting wage to $15/hour.”

The company did not provide guidance for the coming year. Analysts noted that it would be difficult for Target to top its growth in 2020 as other retailers are likely to see their businesses bounce back in the next few months.

Target’s stock lost 6.8 percent on Tuesday.

Instacart, the grocery delivery company, said on Tuesday that it has raised another $265 million in a funding that values it at $39 billion, more than doubling its valuation for the second time in a year.

Andreessen Horowitz and Sequoia Capital, which are existing investors in Instacart, participated in the latest financing for the eight-year-old start-up. Over the last year, Instacart has raised two rounds of funding totaling $525 million. It was previously valued at $17.7 billion.

The pandemic has supercharged Instacart’s growth. Customers eager to avoid shopping in stores are using the company’s app-based grocery ordering service. Laid-off workers have also turned to gig-economy jobs, like Instacart shopping, to make money. Instacart now has 500,000 shoppers who work on contract.

“This past year ushered in a new normal, changing the way people shop for groceries and goods,” Nick Giovanni, Instacart’s chief financial officer, said in a statement.

Instacart has weathered criticism of its business model as it has expanded. Earlier this year, layoffs of some of Instacart’s few unionized workers prompted accusations of union busting. Grocery stores have said the app’s fees of around 10 percent have made it difficult to make a profit.

The company delivers goods from 600 retailers across 45,000 stores in the United States and Canada. It has expanded beyond groceries to include office supplies, sporting goods, prescription drugs and pet supplies from chains including Staples, Dick’s Sporting Goods, CVS and Petco.

Instacart said it planned to use the new funding to hire more employees and to expand business lines including advertising for consumer packaged goods companies and enterprise software for retailers.

In a statement, Jeff Jordan, a partner at Andreessen Horowitz, said his firm had been impressed by the way Instacart had shown resilience in the pandemic and “met the moment of 2020.”

The company has been named as a candidate to go public. In January, it appointed Mr. Giovanni, formerly of Goldman Sachs, as chief financial officer.

-

More evidence of a difficult holiday season at department stores rolled in on Tuesday, as Nordstrom reported a 20 percent decline in net sales in its fourth quarter to $3.6 billion. It posted a net profit of $33 million compared with $193 million a year earlier, though its loss for the year was $690 million. The results came after Macy’s said last week that its fourth-quarter sales fell 19 percent. Department stores have been hit hard during the pandemic as newly isolated consumers slashed apparel spending and foot traffic to malls tumbled.

-

Volvo Cars one-upped larger rivals like General Motors and added momentum to the movement toward electric vehicles on Tuesday by saying it would convert its entire lineup to battery power by 2030, no longer selling cars with internal combustion engines. The declaration by the Swedish carmaker is the latest attempt by a traditional auto company to break with its fossil fuels past. It is also one of the most ambitious proposals and ratchets up the pressure on others to follow suit. “If you want to be in the game you have to transform fast,” Hakan Samuelsson, the chief executive of Volvo, said in an interview. “Otherwise you get stuck in a shrinking segment.”