Rising Covid-19 cases are taking a steep toll on economic activity, battering the labor market even as new vaccines offer a ray of hope for next year.

The number of Americans filing initial claims for unemployment insurance remained high last week, the Labor Department reported Thursday. After dropping earlier in the fall, claims have moved higher, and they remain at levels that dwarf the pace of past recessions.

There were 935,000 new claims for state benefits, compared with 956,000 the previous week, while 455,000 filed for Pandemic Unemployment Assistance, a federally funded program for part-time workers, the self-employed and others ordinarily ineligible for jobless benefits.

On a seasonally adjusted basis, the number of new state claims was 885,000, an increase of 23,000 from the previous week.

Consumer caution, coupled with new restrictions on business activity like indoor dining, has pummeled the hospitality industry, lodging, airlines and other service businesses. The debut of a coronavirus vaccine this week offers the prospect of relief, but until mass inoculations begin next year, the economy will remain under pressure.

“Businesses are closing, and as a result, we are seeing job losses mount — and that’s exactly what we were fearful of going into the winter,” said Rubeela Farooqi, chief U.S. economist at High Frequency Economics. “It’s going to be a challenging few months, no doubt.”

At the end of November, more than 20 million workers were collecting unemployment benefits under state or federal programs, Labor Department data indicates.

With the weakening economy as the backdrop, Republican and Democratic leaders in Congress continued talks on Wednesday on another pandemic relief bill, something that economists have warned is overdue. Without action, two key programs for unemployed workers will expire this month, cutting off benefits to millions.

“We are not moving in the right direction,” said Gregory Daco, chief U.S. economist at Oxford Economics. “With the looming expiration of benefits, it’s even more worrisome.”

Data released on Wednesday showed a 1.1 percent drop in retail sales in November, a disappointing start to the crucial holiday season. Gus Faucher, chief economist at PNC Financial Services, expects economic growth to be weak for the next few months before picking up later in 2021.

“Until we get a lot of people vaccinated, the economy will face a difficult test,” he said. “I don’t know if we will see an outright contraction or the loss of jobs, but the pace of improvement will slow markedly.”

The National Labor Relations Board said on Thursday that it had found merit in a complaint that Amazon wrongfully fired a warehouse worker in retaliation for organizing colleagues concerned about pandemic safety conditions.

Kevin Petroccione, a congressional liaison for the National Labor Relations Board, said if Amazon did not settle, the board would file a formal complaint against the company.

Amazon did not respond to a request for comment. The finding was earlier reported by Vice.

The charge of unfair labor practices was brought by Gerald Bryson, who worked at Amazon’s warehouse in Staten Island, N.Y. Mr. Bryson had joined with other workers, including one named Christian Smalls, in a protest over safety concerns in late March after the pandemic struck. Amazon immediately fired Mr. Smalls. About a week later, Mr. Bryson protested again in the parking lot of the building.

Amazon fired Mr. Bryson about two weeks later, saying he had violated the company’s vulgar language policy during a confrontation with another worker in the second protest, according to Frank Kearl, Mr. Bryson’s lawyer.

In June, Mr. Bryson filed a case with the National Labor Relations Board, effectively saying that Amazon selectively enforced its vulgar language policy as an excuse to retaliate against Mr. Bryson for his organizing. Mr. Kearl said the agency told him of the finding late last month.

An Amazon spokeswoman, Lisa Levandowski, accused Mr. Bryson of a number of behaviors that she said were “a clear violation of our standards of conduct and harassment policy.”

“We look forward to sharing the facts on this case before an administrative law judge,” she said.

If Amazon does not reach a settlement, which could include back pay or reinstating Mr. Bryson’s job, the agency plans to file a complaint to be heard by an administrative law judge. It filed a similar retaliation complaint against Amazon in a case of a worker in Pennsylvania who protested conditions during the pandemic. That case is pending.

The cryptocurrency company Coinbase has joined the rush of start-ups looking to go public.

The company said on Thursday that it had filed confidentially for an initial public offering with the Securities and Exchange Commission. It gave few other details.

Coinbase, which is based in San Francisco, has become the most valuable American cryptocurrency company by making it easy for people to buy and sell Bitcoin and other digital tokens. The firm takes a fee each time a customer places a trade order. When the company last raised private funding in 2018, it was valued at $8 billion.

Coinbase, which was founded in 2012, has raked in hefty revenues recently as the price of cryptocurrencies has shot up. Bitcoin’s value hit a record high earlier this month and has surged over the past two days.

On Wednesday, the price of a Bitcoin rose above $20,000 for the first time. On Thursday, it rocketed above $23,000.

But Coinbase has also been hit by questions in recent months over its management practices and its treatment of minority employees. In late 2018 and early 2019, the company experienced a mass departure of 15 Black employees; at least 11 of them had informed the human resources department or their managers about what they said was racist or discriminatory treatment at the start-up.

The company said that it plans to launch its I.P.O. after the S.E.C. “completes its review process, subject to market and other conditions.”

In recent weeks, the home-rental company Airbnb and the food delivery company DoorDash have both gone public and soared in their first day of trading, generating new interest in tech-related companies.

The Washington Post has three million digital subscribers, a 50 percent jump from last year, the publisher, Fred Ryan, told employees in a note on Thursday.

“This great journalism has increased our readership to record-breaking levels,” he said in an 800-word memo.

The three-million-subscriber milestone does not include The Post’s print product, which has an average paid weekday circulation of 200,653, according to the Alliance for Audited Media. The New York Times has over seven million print and digital subscribers, while The Wall Street Journal has 3.1 million.

Mr. Ryan’s note highlighted strong advertising performance in the last three months of the year, as the broader ad market picked up for most publishers. He said that The Post had been profitable since 2015 and would also finish this year in the black.

The memo did not give specific data on the The Post’s business, including revenue, cost or profit. The paper is privately owned by Amazon founder Jeff Bezos and doesn’t abide by financial disclosure rules that apply to public companies. The New York Times and The Wall Street Journal, for example, disclose revenue and profit statements in addition to subscription figures.

The company plans to expand its international coverage by adding two new bureaus — one in Sydney, Australia, and another in Bogotá, Colombia — and will increase staff in London and Seoul, South Korea, as part of an effort to create a 24-hour newsroom, according to a separate note from Martin Baron, the executive editor, and Douglas Jehl, the foreign editor. The Post also plans to broaden its technology coverage, adding eight reporters and editors to a team that already includes 19 journalists.

Altogether, The Post will add 43 newsroom jobs in 2021. The Post’s newsroom head count will increase to about 1,010, “the most ever,” according to Mr. Baron and Mr. Jehl. The Post currently employs 2,500 people.

The new hires will probably be overseen by a new top editor. Mr. Baron, who turned 66 in October, is expected to announce his retirement soon. He has run The Post for eight years, and it has won 10 Pulitzer Prizes under his leadership.

As they closed in on a $900 billion stimulus deal, top Democrats and Republicans in Congress haggled on Thursday over a handful of remaining issues that could help determine how much power President-elect Joseph R. Biden Jr. will have to act once he takes office to provide additional help for the sputtering economy.

Democrats were making a last-ditch effort to provide emergency aid to states, which they argued was critical to helping states weather the pandemic and avoid huge layoffs and cuts in services that could reverberate through the economy. Republicans were working to limit the power of the Federal Reserve to bail out businesses, municipalities or other institutions in the future.

Both disputes could carry heavy consequences for Mr. Biden, who will take office facing a cascade of fiscal crises in states around the country — which will be even more dire if Congress fails to provide at least some assistance now. And reining in the Fed’s lending authority could close off crucial avenues for his administration to stave off more economic havoc.

With Congress running out of time to cement a stimulus agreement and avoid a government shutdown on Friday, leaders remained optimistic that they would ultimately find a resolution, although their wrangling could bleed into the weekend.

“We made some progress this morning,” Speaker Nancy Pelosi of California, told reporters at the Capitol. Asked if a final agreement would be announced by the end of Thursday, she said: “We’ll let you know.”

The plan under discussion would provide a dose of badly needed relief after months of stalled negotiations and amid a national public health crisis that has killed more than 307,000 people.

That includes a new round of stimulus payments, probably $600, to American adults; a temporary infusion of enhanced federal jobless aid of around $300 per week; and rental and food assistance. It would also revive a loan program for struggling small businesses and provide funding for schools, hospitals and the distribution of the vaccine.

With plans to merge a final agreement with a sweeping omnibus government funding package, Congress may have to approve another stopgap spending measure to avert a government shutdown on Friday while negotiators put the finishing touches on the stimulus deal. Senator Mitch McConnell, Republican of Kentucky and the majority leader, warned Republicans on Wednesday that they should prepare to remain in Washington through the weekend.

“I hope it wouldn’t be more than 24 or 48 hours,” Senator John Thune of South Dakota, the No. 2 Republican, said of a possible stopgap bill, adding, “I really think this is coming to a close.”

Ms. Pelosi, Senator Chuck Schumer of New York, the minority leader, and Steven Mnuchin, the Treasury secretary, spoke late Wednesday evening to continue ironing out differences over the measure, a spokesman for Ms. Pelosi said, and their aides continued talks throughout the day on Thursday.

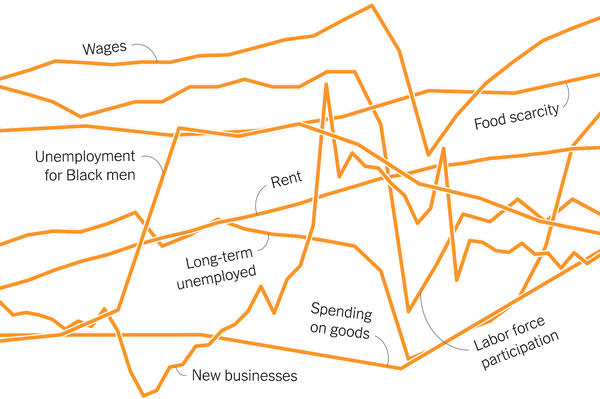

Nearly a year after the coronavirus outbreak, the full impact of the pandemic on the U.S. economy remains unclear. Some of the most obvious indicators are in conflict: As some companies report enormous profits, the number of unemployed Americans is nearly 10 million more than it was in February, and hundreds of thousands are expected to have filed new unemployment claims last week.

The Times interviewed a range of economists and experts who suggested looking at eight measures to understand the state of the economy that President-elect Joseph R. Biden Jr. will face on Jan. 20.

-

Wages: That wages and salaries have bounced back quickly is a sign that things are on track for a rapid recovery. During the last recession — which Mr. Biden and then-President Barack Obama inherited in 2009 — drops of wages and salaries took years to recover.

-

Unemployment for Black men: The current crisis has had a particularly negative, persistent impact on employment for Black men, who face an unemployment rate of 11.3 percent, five percentage points higher than the unemployment rate for white men.

-

Long-term unemployment: The number of Americans who are still in the labor force but have been unemployed for more than six months has been increasing since April. A sociologist with a left-leaning think tank said the rise in long-term unemployment, coupled with the fact that millions of workers have left the labor market altogether since February, indicated “a very serious problem in connecting people who are able to produce needed goods and services with the opportunity to do so.”

-

Housing costs: Home prices and rents have risen during the pandemic. But while the rising costs have strained low-income renters, the rise in housing prices typically signals strong economic growth.

-

New businesses: Even as countless businesses have been forced to close over the course of the pandemic, the increase in business applications over the last year is a sign that the economy may be adapting rather than totally seizing.

-

Spending on goods: Though the pandemic has altered Americans’ day-to-day lives, it hasn’t halted their spending as much as some feared it would. Consumption has shifted toward goods over services — buying alcohol from stores instead of from bars, for example — bucking a generational trend toward a service economy.

-

Food scarcity — More families across the country are unable to meet their basic needs for housing and food security, according to a Census Bureau survey.

By: Ella Koeze·Source: Refinitiv

-

A generally upbeat mood prevailed in global stock markets on Thursday, as lawmakers from both parties in Washington signaled they were close to reaching a deal on an economic aid package and as more people received a coronavirus vaccine.

-

Investors are also looking toward an economic recovery sometime next year with one coronavirus vaccine already approved in several countries, and a second close to receiving emergency approval.

-

Still, the pandemic is far from over and continuing to take a staggering human and economic toll. Claims for state unemployment insurance illustrated this on Thursday, with 935,000 filing new claims last week, the Labor Department said.

-

The market gains on Thursday were relatively small: The S&P 500 rose about 0.6 percent. The Stoxx Europe 600 gained 0.3 percent, while the FTSE in Britain was down 0.3 percent. Most Asian indexes closed the day with gains.

-

In Washington, talks continued on a $900 billion stimulus plan that would provide a new round of direct payments to millions of Americans as well as additional unemployment benefits, food assistance and rental aid. Republicans and Democrats alike signaled that they were ready to coalesce around the main elements, though a final agreement hasn’t been reached.

-

The Federal Reserve chair, Jerome H. Powell, on Wednesday made a point of saying the central bank was in no mood to begin scaling back its efforts to bolster the economy. He said the Fed’s policy decisions were intended to show that policymakers would “deliver powerful support to the economy until the recovery is complete.” He said the economy would face near-term challenges, but would likely bounce back quickly once vaccines were widely available, perhaps by midyear.

-

Unilever, a major advertiser, said it would resume spending in January on U.S. ads on Facebook, Instagram and Twitter but would continue to monitor the social media platforms for hate speech, misinformation and postelection “polarization.” The company stepped away in June but said on Thursday that it was “encouraged by the platforms’ new commitments and reporting to monitor progress.”

-

The Bank of England left its benchmark interest rate at 0.1 percent and did not increase its purchases of government bonds. In November, at its last meeting, the bank’s Monetary Policy Committee expanded the bond purchases by £150 billion. The bank said Thursday it would continue to aim for total asset purchases of £895 billion, or $1.2 trillion. The bank also extended by six months a program that allows commercial banks to borrow money at or close to the benchmark interest rate, if they funnel the money to small and midsize businesses.

-

European Union authorities approved Google’s acquisition of the fitness-tracking company Fitbit after a lengthy review to determine whether the $2.1 billion takeover violated antitrust laws. European regulators had been under pressure to block the deal, first announced last year, but allowed it to move forward after Google agreed not use the health and fitness data collected from Fitbit’s wearable devices and services to target ads at internet users. Google also agreed to continue providing its free Android software to competing makers of fitness and health devices.

-

Tyson Foods has fired seven workers accused of being involved in a betting pool over how many employees would get the coronavirus, the company said Wednesday. The son of a meatpacking worker who died in April filed a suit claiming that the manager of the Waterloo, Iowa, pork plant organized a “cash buy-in, winner take all” betting pool. In all, about 1,000 workers at the plant — about a third of the work force — tested positive for the virus. Tyson had hired the law firm Covington & Burling to conduct an independent investigation of the matter, led by Eric H. Holder Jr., the former U.S. attorney general.