Choosing to take some money out of your 401(k) “early”—before age 59½—is something that makes many financial advisers shudder.

Don’t fiddle with your nest egg, they preach. And for good reason. The government generally slaps a 10% penalty on early withdrawals. And you lose investment gains that the withdrawn cash might have had.

But is it really so wrong to tap your account (whether by withdrawal or just a loan) if you need the money? Would it be better to suffer when you need cash, perhaps to run up credit-card balances instead, while your 401(k) sits idly by?

Last year, because of Covid-19 and the lockdowns, we watched an experiment play out on the issue nationwide. Congress allowed cash withdrawals from 401(k)s and IRAs for people affected by Covid, of up to $100,000 without the 10% penalty. Some called it a lifesaver. In the end, a limited number of people took withdrawals—6.3% of eligible participants at Fidelity Investments, the nation’s largest 401(k) provider, for example, and 5.7% at Vanguard Group.

Because the market rallied, many of them at least partially restored their accounts quickly. The money they took out didn’t enjoy the gains, of course.

So, our debate follows: Based on this experience, should withdrawals be easier, to accept that these accounts do double duty as emergency funds? Or must people be discouraged from raiding retirement funds?

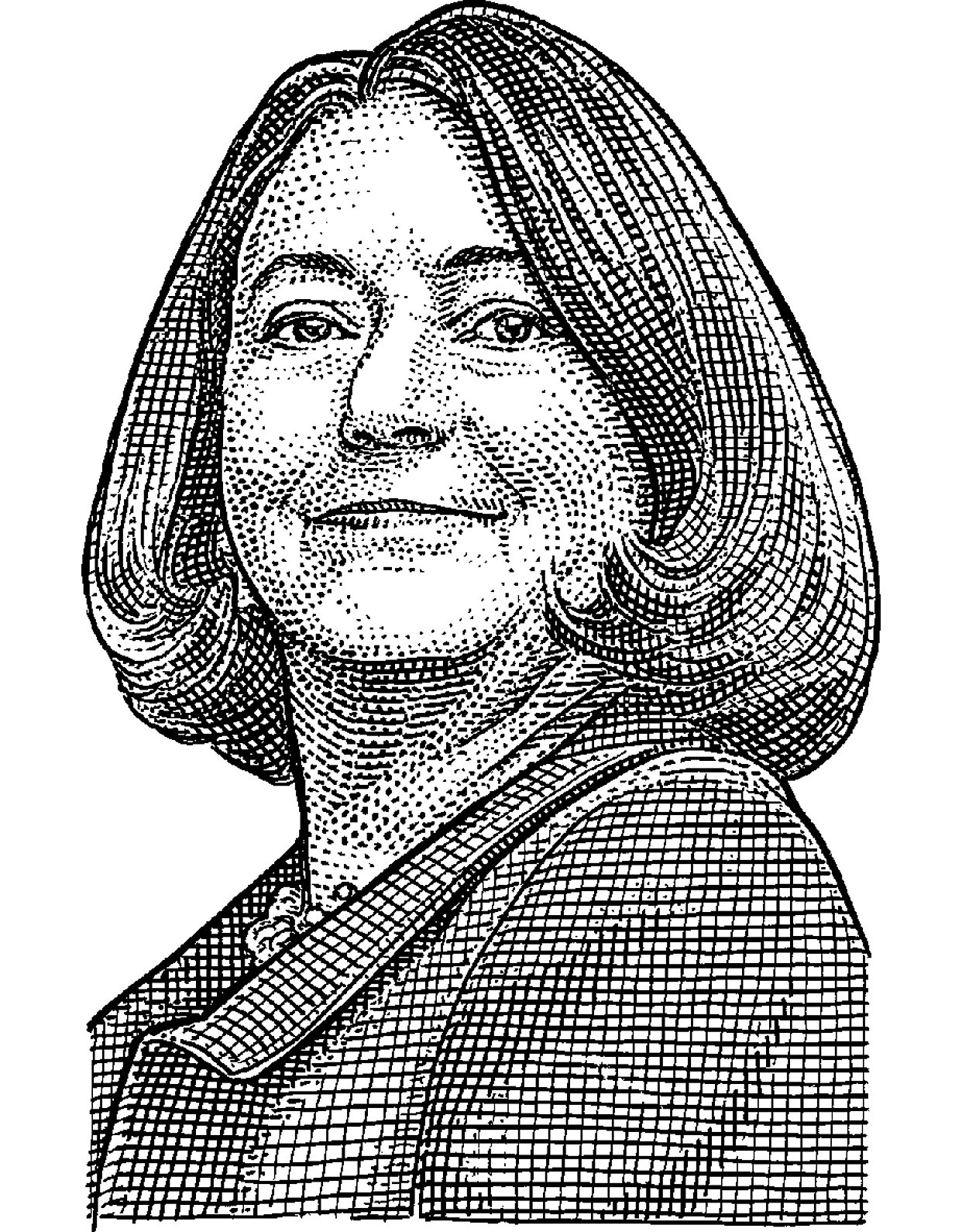

Norbert J. Michel, director of the Heritage Foundation’s Center for Data Analysis, argues that people should control their own money, not Congress, and that the 10% penalty should be waived permanently. Olivia S. Mitchell, director of the Pension Research Council at the Wharton School of the University of Pennsylvania, writes that early withdrawals are financially damaging.

YES: Let People Decide How to Use Their Savings

By Norbert J. Michel

The Covid pandemic has shown that savings are crucial when people are confronting unexpected circumstances. But often, a chunk of people’s savings is locked away in retirement accounts, thanks to financial regulations.

That must change. People grappling with difficult times should decide when and how their retirement savings can be best used—not members of Congress. We should permanently waive the 10% penalty on early withdrawals.

Setting aside funds for retirement is important, but using part of that money before retirement—such as to prevent an eviction, pay down debt or fix a car to get to work—can be more beneficial than keeping it stowed. Congress should allow people to save and withdraw their savings for any reason, at any time, without limitations. People need more economic freedom and less federal paternalism.

The dominant view holds that people will squander their money if they don’t face withdrawal restrictions, which will leave Congress with no option but to raise taxes to help support the growing tide of impoverished elderly citizens on Social Security.

But such restrictions insult the intelligence and integrity of millions of people. These rules assume that people are incapable of understanding their own circumstances and interests, as well as basic financial concepts. It is a condescending and false view.

Consider this: When Congress waived the penalty on early withdrawals last year, relatively few people opted to tap their retirement funds. It seems as though savers have more restraint than lawmakers and advocates give them credit for.

Time enough

It is true that people may sacrifice returns in their retirement accounts after making early withdrawals. Some critics argue that the consequences of this could be dire—people might be forced to work many years more than they had planned, for instance. So, the logic goes, rather than being allowed to take early withdrawals, people should be forced to do things like tap home-equity lines of credit or cut their spending.

Share Your Thoughts

How do you think regulations should change, if at all, when it comes to 401(k) withdrawals? Join the conversation below.

But it is also possible that new rules, ones that allow people to put as much money as they want into retirement accounts, could spur them to put more funds into their plans after they make withdrawals. And that might allow them to more than make up for any losses.

As for the suggested alternatives to making withdrawals, it’s far better to let people assess the risks and make choices about their own money, instead of dictating what they can do.

Social Security provides a good example of what can go wrong with federal regulations on retirement saving—it’s paternalism on steroids.

With Social Security, the government tries to ensure that people have some money when they retire by dictating how they can save. But this is a much worse deal for workers than simply letting them control their own money. Social Security delivers a comparatively lower return than a private savings account, and people who die before retirement, or early on in retirement, lose all the money they put in. (And, of course, the money they put in isn’t really for themselves in the first place, because their contributions actually pay for other retirees.)

If people were able to save their own Social Security contributions, these two problems would be mitigated, at the very least. And because people could control their own money, they would have an incentive to save more than they would otherwise. For the same reason that people are hesitant to book nonrefundable flights, many hesitate to lock up their savings in restricted retirement accounts.

Individual freedom

To be sure, it’s understandable to feel we have a moral obligation to help fellow human beings make it through retirement. But it doesn’t follow that assigning the government the authority to usurp individual freedoms is the best way to accomplish the goal. In a free-enterprise system, people will develop ideas and start businesses to help others because that’s what earns them a profit—such as creating an app that helps people track and manage savings.

In both Canada and the U.K., unrestricted retirement accounts actually induce people to save more, with lower-income and younger workers the most likely to take advantage of such opportunities.

This evidence contradicts the notion that people are incapable of gaining basic financial literacy and saving for themselves. Moreover, it demonstrates how federal paternalism prevents Americans from becoming financially secure and moving up the economic ladder.

People don’t need federal rules to tell them what qualifies as a socially acceptable time or way to spend their own savings.

Dr. Michel is director of the Heritage Foundation’s Center for Data Analysis. He can be reached at reports@wsj.com.

NO: Early Withdrawals Are Financially Damaging

By Olivia S. Mitchell

Lawmakers would be making a mistake if they made it simpler for people to make early withdrawals from retirement plans. It would leave many people in financial straits and unprepared for retirement.

Why?

When you take your retirement cash early, that money won’t have a chance to earn returns from now to your retirement date. For example, if a 40-year-old took $50,000 out of her account today, by retirement at age 67 she would have forgone more than $223,000 in retirement assets, assuming a moderate annual return of 5.7%. That works out to a cut in her retirement income of about $14,000 a year for the rest of her life.

The opportunity cost is even greater when the stock market has been soaring—as it has been doing lately. People who took money out of their accounts when rules were eased last year lost the chance to boost their money during that strong run.

Serious consequences

All of those lost returns have serious consequences. For instance, people could be forced to work another decade or so to make up for their depleted retirement accounts.

That possibility may become more acute very soon., as the Social Security system will likely run short of funds within 10 years. This makes it even more critical for people to increase saving for their own retirement and not withdraw money early.

Finally, remember that retirement accounts are legally protected against most bankruptcy filings, but once the money is withdrawn, it becomes subject to liens and legal judgments. Even if you’re in dire financial straits, you must keep the pension money protected.

Some advocates for dropping limits on withdrawals suggest it is paternalistic to take decision-making out of people’s hands. People should be able to handle their money as they see fit, the advocates say, and use Social Security as an example of a broken system: If people had control over their own payments, they would generate a better return and contribute more toward their retirement.

But that doesn’t work in the real world. Given that Social Security is a pay-as-you-go system, it would be impossible to move immediately to a private-account system, as today’s payroll taxes go to support today’s retirees. My work on President Bush’s Commission to Strengthen Social Security in 2001 offered a path to solvency that included a personal account for a portion of one’s contributions, but that was workable back when the system’s revenue exceeded costs—and that is no longer the case.

More important, like it or not, many Americans suffer from striking financial illiteracy, meaning that a huge investment in education would be required to ensure that people do a good job planning, saving and investing. We’re very far from that at present. While there might be some exceptions, most countries have restrictions, making it clear that they recognize the dangers of not having them.

The ultimate argument critics make, however, is that thousands if not millions of people are in deep financial distress, and withdrawals would be the perfect solution to their situations.

But there are plenty of moves people can take that are superior to retirement-plan withdrawals—which eat into their tax-deferred contributions and investment earnings.

For instance, if you work for a company where you’ve contributed to an employer-provided retirement account, investigate whether you can borrow from the plan. Such loans are typically far less costly and easier to take out, without affecting your credit record. They’re not a perfect solution, though: These loans must be repaid, and if you lose your job, the entire amount must be repaid within a short time. You might also investigate other sources of money to tide you over, such as home-equity loans. If you’re struggling to repay your student loans, there is a long list of programs offering assistance and forgiveness. In addition, people with too many high-interest-rate credit cards may benefit from consolidating them, and from asking for help with a debt-management plan.

The spending side

Just as important, consider revising your spending plan and budgeting more carefully to make it through the pandemic—and beyond. Make a list of everything you spend money on and eliminate every item that isn’t absolutely essential.

This may include extra cellphone services, gym memberships, special TV subscriptions and eating takeout food when you could cook it yourself for less. If you’re not driving as much as you did pre-pandemic, look for less-expensive auto insurance that charges you just for the miles you drive. Defer vacations (if you were planning any!).

Last but not least, get as much information as you can. Financial literacy is an important factor in protecting people from financial fragility. Indeed, my recent research shows that financially literate people have been better able to handle the pandemic shock, confirming that knowledge provides additional resilience in trying times.

Dr. Mitchell is director of the Pension Research Council at the University of Pennsylvania’s Wharton School. She can be reached at reports@wsj.com.

Copyright ©2020 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8